Mempersiapkan keberlanjutan bersama Amartha

Melayani keuangan mikro dan pendanaan berkelanjutan

Memberdayakan UMKM perempuan beserta keluarga dan lingkungannya

Mendorong pertumbuhan yang lebih inklusif dengan memajukan perekonomian pedesaan

Lebih dari Rp 17.3 TriliunModal Usaha Disalurkan

Lebih dari 2.1 JutaUsaha Mikro Diberdayakan

TKB 98.24%Total TKB90

Beragam Solusi Amartha untuk Kesejahteraan Merata

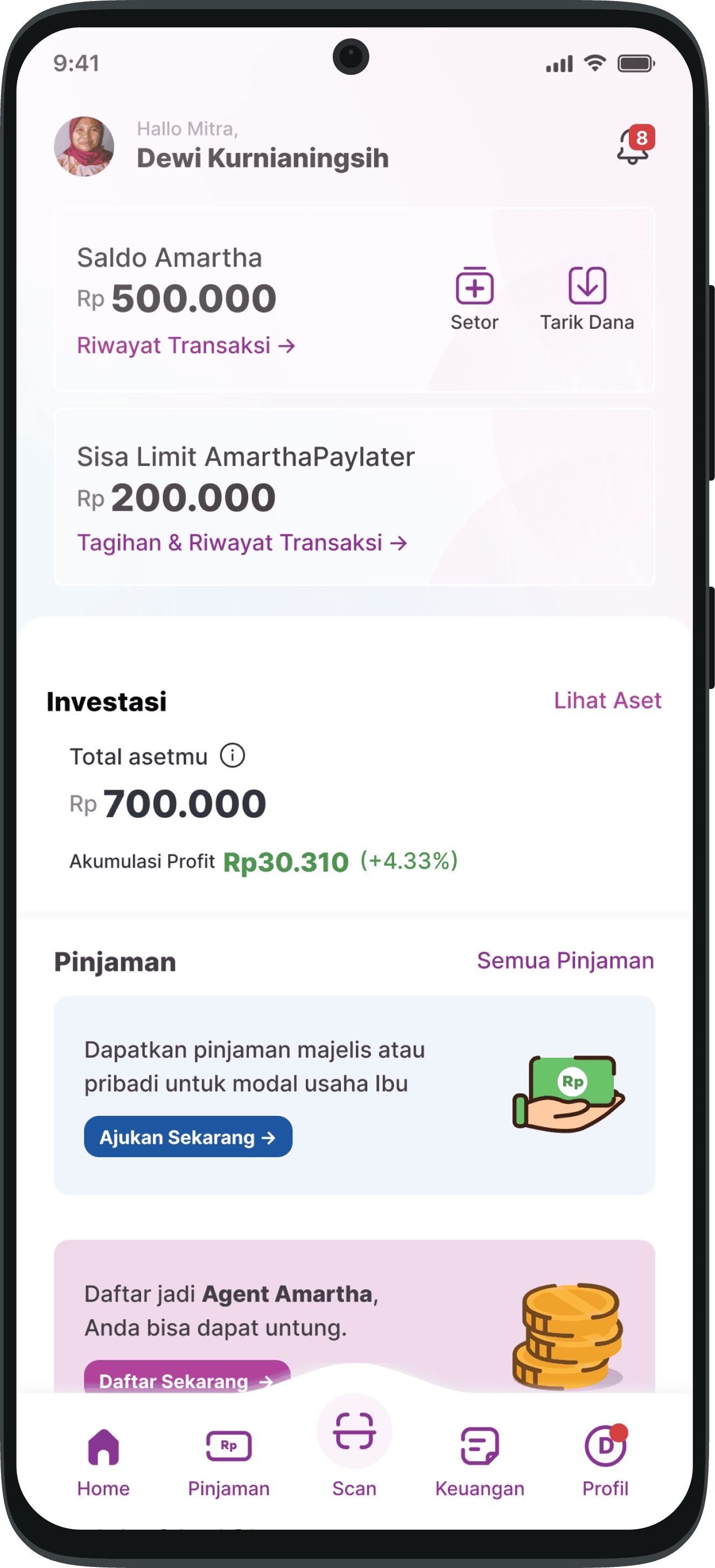

Untuk Individu

Pilihan solusi finansial berupa pinjaman dan pendanaan untuk individu hingga pemilik UMKM

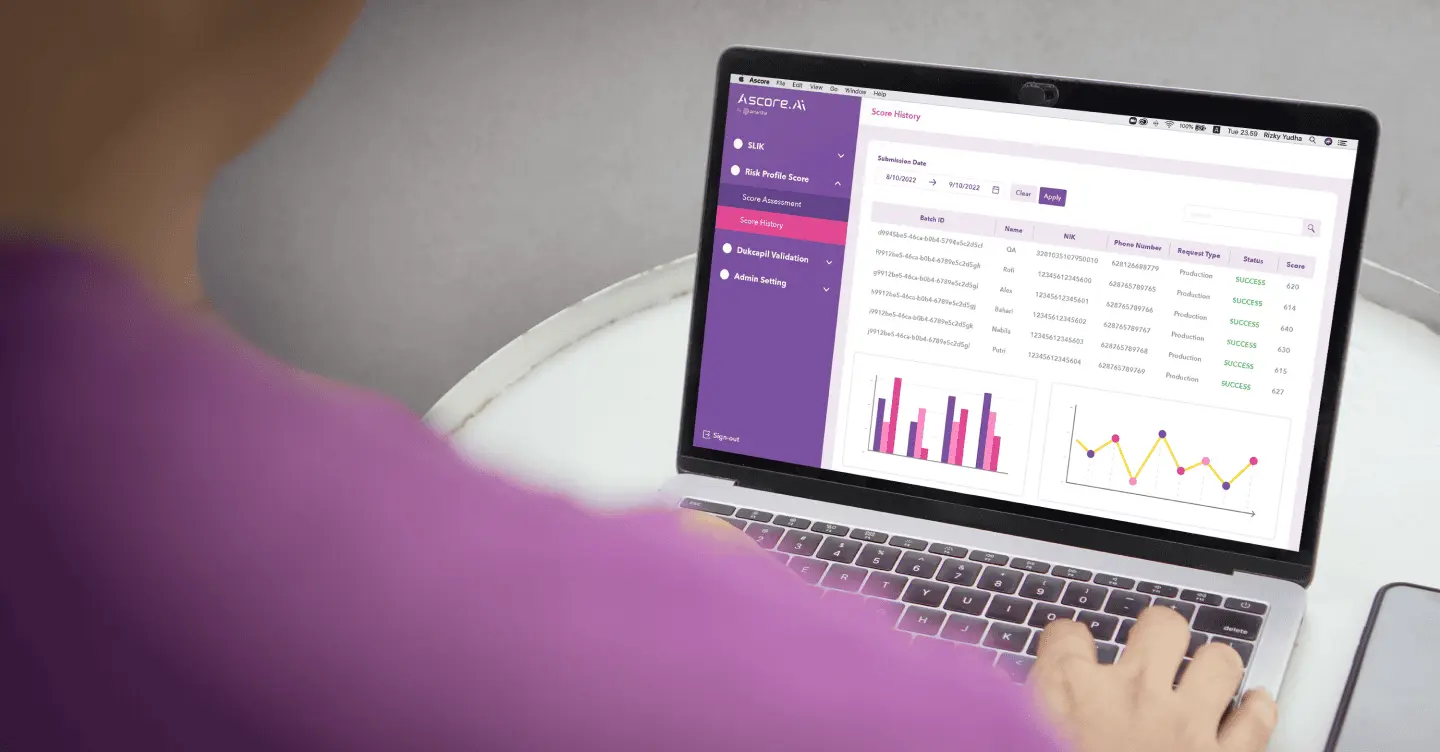

Untuk Bisnis

Pilihan solusi pendanaan yang berdampak sosial bagi perusahaan atau instansi

Solusi andalan dari Amartha

AMARTHAFIN

Semua yang Anda butuhkan untuk kembangkan aset

Melakukan pendanaan, mengelola dan mengembangkan aset keuangan Anda, semua dalam satu aplikasi

Sertifikasi dan Penghargaan untuk Komitmen dan Kualitas Amartha

News and Promo

Berizin dan Diawasi oleh Otoritas Jasa Keuangan